![]() On May 11 of this year, 74% of Germany’s electricity was produced from a combination of solar and wind power, driving electricity prices into the negative for much of the afternoon.

On May 11 of this year, 74% of Germany’s electricity was produced from a combination of solar and wind power, driving electricity prices into the negative for much of the afternoon.

Meanwhile, in the United States, fossil fuels accounted for 67% of this country’s electricity. In the US, the chief arguments against renewable energy include: a) green energy is bad for the economy; b) green energy kills jobs; and c) green energy is expensive compared with fossil fuels.

Despite its apparent green energy handicap, Germany’s economy is still standing. With a quarter of the US population, Germany’s economy is the world’s fourth largest in terms of GDP.

The architect of Germany’s energy revolution, economist Jeremy Rifkin, argues that green energy critics have it backwards when it comes to the impact of renewable energy on economic growth. Far from annihilating the German economy, Mr. Rifkin argues that renewable energy is an essential component of a third industrial revolution that will potentially triple productivity, while slashing marginal costs. According to Mr. Rifkin, the resulting “Internet of Things” and “Collaborative Commons” that emerges from the German third industrial revolution will propel Germany’s economy well beyond countries like the United States that rely on sunset fossil fuel energies and reject investment in modern communications, energy and logistics infrastructure.

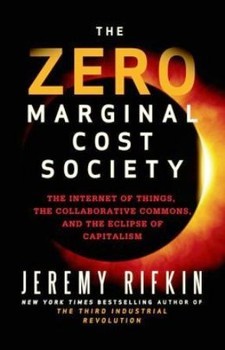

Jeremy Rifkin is the bestselling author of twenty books on the impact of scientific and technological changes on the economy, the workforce, society, and the environment. His books include the New York Times bestseller The Third Industrial Revolution, and his latest, The Zero Marginal Cost Society: The Internet of Things, the Collaborative Commons, and the Eclipse of Capitalism.

Mr. Rifkin is the principle architect of the European Union’s Third Industrial Revolution long-term economic sustainability plan to address the triple challenge of the global economic crisis, energy security, and climate change. The Third Industrial Revolution was formally endorsed by the European Parliament in 2007 and is now being implemented by various agencies within the European Commission as well as in the 27 member-states.

Mr. Rifkin has served as an adviser to Chancellor Angela Merkel of Germany, President Nicolas Sarkozy of France, Prime Minister Jose Socrates of Portugal, Prime Minister Jose Luis Rodriguez Zapatero of Spain, and Prime Minister Janez Janša of Slovenia, during their respective European Council Presidencies, on issues related to the economy, climate change, and energy security. He currently advises the European Commission, the European Parliament, and several EU and Asian heads of state.

So, my question for you is, why hasn’t Germany’s economy crashed? One of the principal arguments against renewable energy is that it kills jobs and has catastrophic effects on the economy. But Germany still seems to be standing – why is that?

Well, let me go back and give a little bit of history to this. When Chancellor Merkel became chancellor, she asked me to come to Berlin to address the question, “How do we grow the German economy and create new business opportunities and jobs?” And when I got to Berlin, the first question I asked the new chancellor was, “How do you grow the Germany economy, or the EU economy, or the global economy in the last stages of a great energy era?”

If you look at every economic paradigm in history, they all have a similar signature: when an economic paradigm shift occurs, three technology revolutions emerge, and converge to create a general purpose technology platform. New forms of communication to manage economic activity. New forms of energy to power economic activity. New forms of transport and logistics to move economic activity.

When they come together in a general purpose technology platform or infrastructure that’s seamless, it changes temporal-spatial relationships. It allows economic activity to play over a larger field in time-space, and to create a more integrated economic society.

For example in the 19th century, printing and the telegraph emerged as a communication media, and it congealed with cheap coal and the steam engine for energy and power, and the locomotive and national rail systems, which allowed us to go from local to national markets. It was a change to our economic core, and it allowed us to create vertically integrated shareholding companies to create economies to scale, put out mass consumer products, hire a lot of people, and move the economic agenda.

In the 20th century, the telephone, and, later, radio and television became a communication media to manage and market a cheap oil-powered society. And the new transport and logistics system was the internal combustion engine and national road systems.

So, the first industrial revolution gave us an urban economic environment. The second industrial revolution gave us an urban-to-suburban dispersed economic environment, and it led to the beginning of modern globalization.

Now, let me explain what this means in terms of the first question you raised about Germany. There’s a big misunderstanding among my colleagues about the nature of productivity. There is a dirty little secret in economics, which the economists don’t want to talk about because it goes right to the hub of their unsuccessful economic theories, which is, “What is the nature of productivity growth?”

All classic/neoclassic economic theory has said there are two factors that create productivity growth: better machines, better workers. But when Robert Solow won the Nobel Prize for economic growth theory back in the ’80s, he let the secret out. He said, “We’ve got a problem.” When we track every single year of the industrial revolution, these two factors account for about 14 percent of productivity and growth. So, where does the other 86 percent come from? They don’t know. It’s called the Solow residual.

And a guy named Moses Abramovitz, former head of the American Economic Association, said, “This is a measure of our ignorance.”

Now, most people say, “How can economists not know? How can they actually not know what’s the nature of productivity growth? That’s the whole basis of economics.”

When economic theory was developed in the 1700s, the big rage was still in physics. So, all the economics philosophers used Newton’s metaphors to make their new discipline seem scientific, so, Newton’s Law, that for every action there’s an equal and opposite reaction. So, Adam Smith borrowed that metaphor for his supply and demand curve.

The only problem with basing an entire economic theory on Newton’s physics is Newton’s physics don’t have anything to do with economics. Nothing. It’s the law of gravity. Economics are based on the laws of energy – the first and second laws of thermodynamics.

The first law of thermodynamics: you cannot create or destroy energy. All the energy in the universe has been there since the beginning. That’s the conservation law.

The second law is energy does change form, but only from hot to cold, from available to unavailable, from order to disorder. So, if you take a piece of coal, it has bounded energy. When you burn it, and it moves into gases, none of the energy’s lost. But now it’s not a hunk of coal. It’s dispersed gases. It can do useful work for you. You can recycle it, but then you have to use energy to recycle it. There’s always an energy loss; that’s called “entropy,” – the amount of energy lost in using energy.

So this is what economics is about. We take low entropy available energy in nature. It can be a metallic ore, a rare earth, natural gas, whatever it is. But everything is bound energy, not just oil. Everything. Every material is.

So, we take those natural resources out of nature, which has bounded energy, and every step of moving it across the value chain – the conversion, the logistics, the distribution, the warehousing – every time we convert that to the next stage in the value chain, there’s energy that’s embedded into the product versus the actual energy wasted that never goes into it just because we have low efficiencies.

So, the 20th century second industrial revolution started at three percent aggregate energy efficiency in 1905. Now, with the amount of energy in each step of conversion that actually went into the product, 97 percent was wasted just in using it.

We got up to 14 percent aggregate energy efficiency in the 1980s, 14 percent embedded in each stage of the value system, but everything that we used from nature in a society back to nature – 14 percent embedded, 86 percent wasted, lost entropy.

So, per Adam Smith, we believe that we’re adding value during every step along the value chain, when the reality is that we’re actually adding cost?

That’s correct.

Gross domestic product is not a measure of your wealth, it’s really a measure of your debt.

You see, John Locke said, “Everything in nature is waste in the commons. And then when we harness it, we create value and property.” In other words, we take nature’s waste and turn it into valuable wealth.

It’s the exact opposite. From a thermodynamic point of view, everything in nature is valuable energy, and whatever we convert, it can be a rare earth metal, we convert it, and every step we’re losing energy, and then eventually, whatever we actually use, whether it be a good or a service, eventually goes back to nature more degraded. We then can recycle it so we don’t lose it all, but it’s a measure of our debt, not a measure of our wealth.

So, it’s a zero-sum game – GDP is our debt to the Earth?

That’s correct.

There’s a paradox deeply embedded in the heart of capitalist theory and practice that we just never saw before. And the paradox has led to the great success of the invisible hand of the marketplace. Now the irony is that paradox is actually becoming so successful that it is actually creating a new economic system flourishing alongside the capitalist market, which we call the “Collaborative Commons.”

You and I, and everyone else, have already been up on the collaborative commons, where we’ve created the videos on YouTube, a news blog or whatever, and we are bypassing the traditional market exchange economy, and we’re in a shareable economy, not an exchange economy. Capitalism creates an exchange economy. Collaborative commons creates a shareable economy.

Hundreds of millions of people already participate in the sharable economy. So, they’re not only sharing entertainment and video news and ebooks and now massive open online courses, they’re now sharing renewable energy. And there’s zero marginal cost on a collaborative commons.

But the expectation was that the zero marginal cost phenomena would not pass across the firewall from the virtual world of bits to the physical world of atoms. Now that firewall’s been breached, and the agent is this Internet of things.

So now, the communication Internet is beginning to emerge and converge within this nascent energy Internet of renewables and a fledgling transport and logistics Internet to create this Internet of things.

There are now hundreds of thousands of hobbyists producing and sharing their own 3-D printed products made out of materials from recycled materials, with open-source software for the instructions on how to make their products.

We never expected, in our wildest imagination, a technology revolution so extreme in its productivity that it can reduce marginal costs to near zero, potentially making some goods and services actually free and abundant beyond market forces.

That’s what’s going on. That’s the big ticket change happening. And what we’re beginning to see in Germany.

Here’s the bottom line – my global team has run an economic study on how much more aggregate energy efficiency and productivity we could get. Our results show that we can go from about 14 percent aggregate energy efficiency, which is the height of the second industrial revolution in the U.S. in 1980s and 1990s, to 40 percent and maybe even 60 percent aggregate energy efficiency in the third industrial revolution. That’s huge.

How does the US fare relative to countries like Germany in the global economy?

Germany’s the most robust industrial economy per capita in the world.

And the U.S. is nowhere. The energy companies have huge sway. They’ve convinced America that we’re energy independent, and that climate change is a hoax. And so, we’re staying in these old 20th century fuels, whose prices are volatile and going up and down wildly on world markets, because we’re in the sunset for the fossil fuel. It’s not sunrise energy; it’s a sunset energy.

Tar sands in Canada are not competitive under $70.00 a barrel. The only reason they’re on the market is because the price of oil keeps going up. Shale gas is a bubble.

What happened to the U.S. is that companies invested wildly in buying up every shale gas deposit at the same time. And they’re milking the sweet spot. Every shale gas deposit has a little sweet spot, you milk it in 18 months, and then there’s nothing there. So, the price of natural gas has gone down dramatically, because they’re all milking the sweet spots of all the deposits they invested in at the same time. Even our Department of Energy in the U.S. and the International Energy Agency have said that, by 2020, those prices are going to go back up again.

What’s happened with solar and wind is it’s been on an exponential curve for 20 years. That’s what a lot of folks in America don’t realize, and Europeans do. A solar watt in 1970 cost something like $66.00. This afternoon, a solar watt is $.66 to produce, and it’s going down, down, down. So it’s on a 20-year exponential curve.

Why can’t America build an Internet of Things?

Remember when Obama said, “You didn’t build that” during the campaign?

Everyone went berserk on the right?

Yes.

What he was saying is, the infrastructure is built by the American people through their tax dollars. If you have the infrastructure, that’s how any business – small, medium, large – plugs into the technology infrastructure. And that’s how you’ll then create your own opportunities. You have to have the telephone lines, and the roads, and the school systems, and the electricity grids, and the pipelines. All of that are underwritten, subsidized, or in some way involved with government laying out infrastructure.

Half the country doesn’t understand that. So, if you eliminate government engagement laying down infrastructure, you’re baked. And what’s happening here is nobody wanted to invest in the third industrial revolution infrastructure.

Nobody wants to invest in the Internet of Things platform. How will we ever be able to move into the next economic era in history and dramatically increase productivity, create a sustainable model?

It almost seems as though we might have to wait until our market collapses and the third industrial revolution rises out of the rubble.

Well, I just don’t know. My hope is the millennial generation will see the opportunities here, because this is really a young person’s revolution. Kids that grew up on the Internet, and they’re now 20, 30, 40, they were empowered in lateral economies of scale. My generation, we thought that – we would say lateral power is an oxymoron. It’s always pyramidal.

But for everyone that grew up on the communication Internet, it is actual lateral power – that their individual entrepreneurial abilities depend on how much they can benefit everyone else in the laterally scaled network.

So, they don’t buy Adam Smith. They read Adam Smith, and they think, “This makes no sense.”

Adam Smith says, “Each person pursues their own self-interest, and by doing so, it optimizes the common good” – which has always been a little dubious. Young people believe by each person benefiting the network, creating social capital by creating things that benefit the network, it increases their social reputation and their social capital allows their social entrepreneurial skills to succeed.

So, what I like about this third industrial revolution is that it borrows the best. This collaborative commons that’s emerging out of capitalism borrows the best from capitalism, the best from socialism. It takes out the bad parts, which means it eliminates the centralization of the market with vertically integrated monopolies, and it eliminates the centralization of command and control from centralized governments in the socialist systems.

But what it does keep is the entrepreneurial spirit of capitalism in each individual. It also keeps the social commitment that we see in socialism that no one’s left behind. So, that’s why our younger generation are social entrepreneurs, and they see themselves as benefiting the world.